The Zacks Small/Mid Cap Core Portfolio (SMIZ) ETF represents the combination of our Small and Mid Cap separately managed accounts (SMAs), drawing upon over a decade of comprehensive research and analysis.

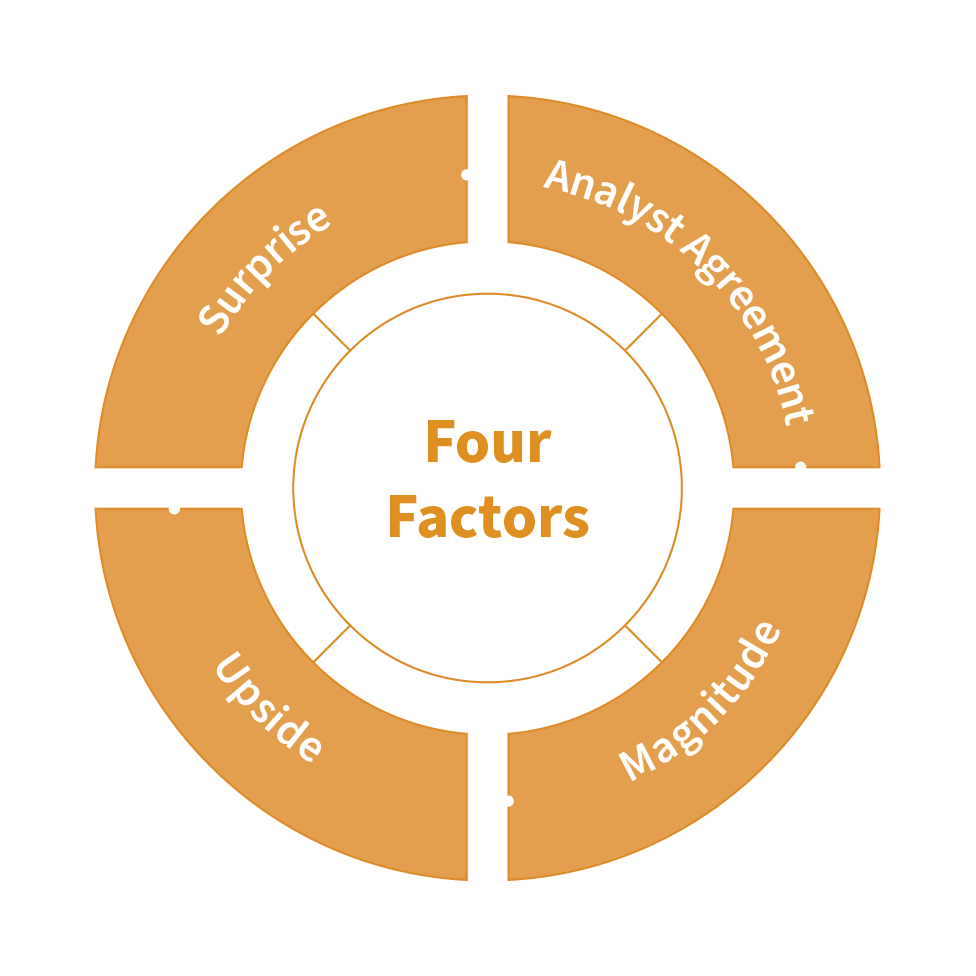

Utilizing the Zacks Proprietary Multi-factor Alpha Model, our portfolio management team identifies a selection of the most liquid US stocks for the SMIZ ETF according to analyst agreement, magnitude, upside and surprise. This results in a portfolio of stocks that are positioned to generate returns that exhibit minimal correlation with broader market indices.

The Zacks Small/Mid Cap Core Portfolio ETF seeks to generate consistent and sustainable returns while minimizing the risk of capital loss in the Small and Mid Cap asset classes.

Comprised of approximately 200 thoughtfully selected companies, this portfolio leverages market anomalies to capture alpha and benefits from diversification. These companies are chosen based on their alignment with our criteria for delivering risk-adjusted returns and diversification advantages. As a result, SMIZ is designed to yield returns that show limited correlation with broader market benchmarks amidst volatile economic environments. The quantitative screens are combined with the qualitative judgment of the portfolio manager based on an analysis of from Zacks Proprietary Multi-factor Alpha Model, valuation, and improving fundamentals.

| Fund Inception | 10/03/2023 |

| Ticker | SMIZ |

| Net Assets | 46,471,055.85 |

| Shares Outstanding | 1,550,000 |

| Asset class | Equity Class |

| Primary Exchange | NYSE |

| CUSIP | 98888G204 |

| Fund Type | Active |

| Benchmark | Russell Mid Cap Index/Russell 2000 Index (50/50 blend) |

| Net Expense Ratio | 0.56% |

| Gross Expense Ratio | 1.47% |

| NAV | |

| Net Asset Value | $29.98 |

| Daily Change | 0.84% |

| Volume | 90,146 |

| Market Price | |

| Closing Price | $29.99 |

| Daily Change | 0.84% |

| 30-Day Median Bid/Ask Spread | 0.25236593% |

| Premium/Discount | $0.01 |

Month end returns as of: 09/30/2023

| 1 Month | 3 Month | 6 Month | Since Inception (10/03/23) | |

| Fund NAV | -3.54% | 5.16% | 26.37% | 20% |

| Market Price | -3.6% | 5.15% | 26.36% | 20.04% |

Quarter end returns as of: 09/30/2023

| 1 Year | 3 Year | 5 Year | 10 Year | Since Inception (10/03/23) | |

| Fund NAV | - | - | - | - | 20% |

| Market Price | - | - | - | - | 20.04% |

Consensus among Zacks portfolio managers regarding changes in earnings forecasts for a stock or asset, helping inform investment decisions for the SMIZ portfolio.

Assesses the significance of recent changes in earnings estimates, with a focus on larger percentage revisions that carry more weight in the analysis to identify substantial shifts.

Measures how the most recent earnings estimate compares to the consensus estimate, identifying stocks with the potential for outperformance when the most recent estimate surpasses market expectations.

Examines a company's track record of earnings per share (EPS) surprises in the previous quarter to gain insights into historical performance and potential future trends.

Submit the form below and a Zacks representative will reach out to answer any questions you have about Zacks ETFs.